Raquel, Fredica and Lisa and Bryan made it. Sixteen weeks of rigorous budgeting and saving and heavy financial lifting.

Raquel, Fredica and Lisa and Bryan made it. Sixteen weeks of rigorous budgeting and saving and heavy financial lifting.

OK, maybe not that intense…but our three families did make a commitment, met with a financial counselor and made major changes in their financial life. And lived to tell about it.

Here’s what they learned:

“Say no to frivolous spending.”

“Live within your means.”

“Don’t overwhelm yourself with credit.”

Each participant started out with a different financial issue. Lisa and Bryan wanted to bulk up their retirement savings. Fredica needed to control her spending. Raquel’s payday loans were spiraling out of control.

But the outcome for the three was the same: a lighter debt load, and more importantly, less stress in their lives.

The takeaway is that financial stress can cause problems in your daily life…which is in line with this recent survey that says employee financial problems or stress can reduce worker productivity.

What did our participants accomplish in 16 weeks? Here’s the skinny:

- paid off four of their credit cards

- learned the difference between needs and wants

- involved their children and developed a family budget

- stopped using credit cards

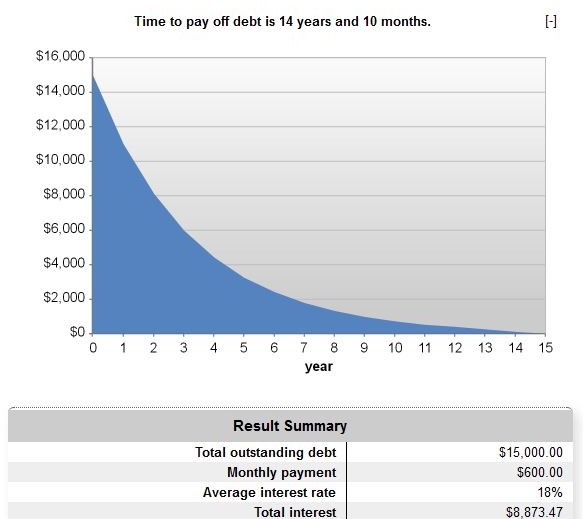

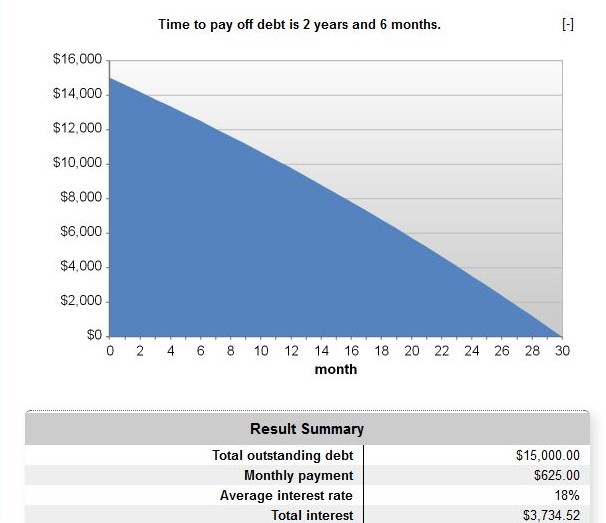

- is paying down her existing credit card debt

- learned to live within her means, and work with what money she does have

- paid down 30 percent of her debt

- is current on all her bills and has stopped using payday loans

- started an emergency fund

If you only remember one thing from this post, remember this: Your household budgets and finances are up to you. It’s a life-long process, not just something you can do once and be done.

But don’t feel like you need to do it alone. Get help from the Consumer Credit Counseling Service or a credit union. Financial education is a primary focus of Kansas credit unions, and credit unions nationwide. Credit unions promote financial fitness, and their goal is to make your financial life easier. Get started on your own by downloading the Money Possible Workbook.

Thank you to Lisa and Bryan, Fredica and Raquel for sharing their stories for the world to hear. Using a public venue to air your dirty laundry can be intimidating. These three credit union members took it in stride to promote the importance of financial literacy, and learned a little something along the way.